With a portfolio of nearly 80 African startups, 500 Global continues to be an active investor on the continent.

2021.06.08

Mareme Dieng

Credit: Murad Swaleh on Unsplash

From 55 startups successfully funded in 2015 to 359 in 2020, Africa appears to be at the dawn of a startup revolution, with the ecosystem growing at a 46% annual rate, which is six times faster than the global average, according to BCG. Today, as one of the world’s leading early-stage investors, 500 Global is eager to leverage its mission of uplifting people and economies, to support the transformation of the African startup ecosystem through the launch of its Africa Innovation Strategy focus. This team’s objective will be to partner with local and international stakeholders in order to co-create interventions targeted at empowering founders and other ecosystem stakeholders to build more supportive communities for founders. We hope to empower some of the continent’s leading startups, by not only investing in African startups through 500 Global funds but also by creating the right environment for them to thrive within their local markets and prepare to scale beyond them.

The Why behind Startup Ecosystems

Through our work building and enabling startup ecosystems around the world, 500 has identified key benefits and domino effects we believe arise from having a thriving startup hub.

We believe startup ecosystems can be catalyzers for economic growth, development, and transformation; generating knowledge and innovations with positive socio-economic benefits. Startups can also be key quality employment generators, particularly for economies intending to diversify the composition of their GDP, and encouraging a greater economic role for the private sector. Startups are commercially minded entities with a high tendency towards adopting new innovations and technologies, and we believe can pioneer highly responsive market-driven solutions to address some of the key socio-economic needs present in our society.

Why we are betting on Africa

With a portfolio of 74 African startups, 500 Global has been and expects to continue to be actively investing on the continent, as we firmly believe in the importance of supporting the growth of the African Startup Ecosystem and its promising potential. We think entrepreneurial culture has always existed among African Ecosystems and has been a central pillar of Africa’s historical economic development.

Growing up in Dakar, I have witnessed first-hand how entrepreneurs and small business owners have advanced an important part of the Senegalese economic activity as key drivers of job creation. According to the GEM report from Babson College, the highest rates of total entrepreneurial activity for women in 2019 are found in sub-Saharan Africa with (21.8%). According to the latest report on entrepreneurship from the African Development Bank, in 2017 alone, 22% of Africa’s working-age population started a business, which for that year was the highest entrepreneurship rate in the world. I believe the African Startup Ecosystem should be built upon this pre-existing entrepreneurial mindset while creating differentiated support systems for both tech-enabled and scalable startups, as well as SMEs. In my opinion, this distinction will be essential in identifying and providing the adequate resources that entrepreneurs and small business owners need to complement their existing mindset with the arising opportunities for expansion that technology unlocks.

From our experience, startup ecosystems in emerging markets cannot be built without considering the underlying infrastructures and mechanisms needed to strengthen the talent pool, attract suitable forms of financing, develop an extensive network, facilitate startup-friendly market opportunities, and transform government agencies into ecosystem enablers.

The African startup ecosystem appears to be experiencing an unprecedented transformation led by the unique combination of technology advancement and entrepreneurship. These efforts are not only an attempt at solving some of the biggest environmental and societal challenges faced by the continent, but we believe also redirects technological advancement towards sustainable growth and transformation.

We believe that the latest exciting evolutions in the continent confirm that Africa is setting off to be one of the most innovative hubs and will drive the development of sustainable technologies. Yet, the potential of a bright soon-to-come future does not erase the fact that the continent is currently facing significant socio-economic challenges that can affect the prosperity of the Startup Ecosystem. From our perspective, those challenges are often intensified by the coordination between the stakeholders activating the different pillars and the fragmentation with surrounding regional markets. In addition, with 54 countries, Africa has the highest number of countries in a single continent which makes it even more challenging to assume that a single Startup Ecosystem strategy could be applicable in the same way to the entire continent.

Our experience supporting emerging markets around the world has shown us that each emerging ecosystem is unique, and there should be a focus on the specific emerging ecosystem in order to facilitate better potential startup performance. We believe it is paramount to accurately understand the local factors and stakeholders within the ecosystem that contribute to the availability of market opportunities for startup growth. Together, we can create joint visions for the direction of the ecosystem, build upon lessons learned from benchmarked international ecosystems and leverage the unique competitive advantages that each country has to offer. As a result, we strongly believe that the emphasis needs to be placed on the creation of coordinated interventions under a shared vision that brings different stakeholders, and their unique value propositions, under one roof.

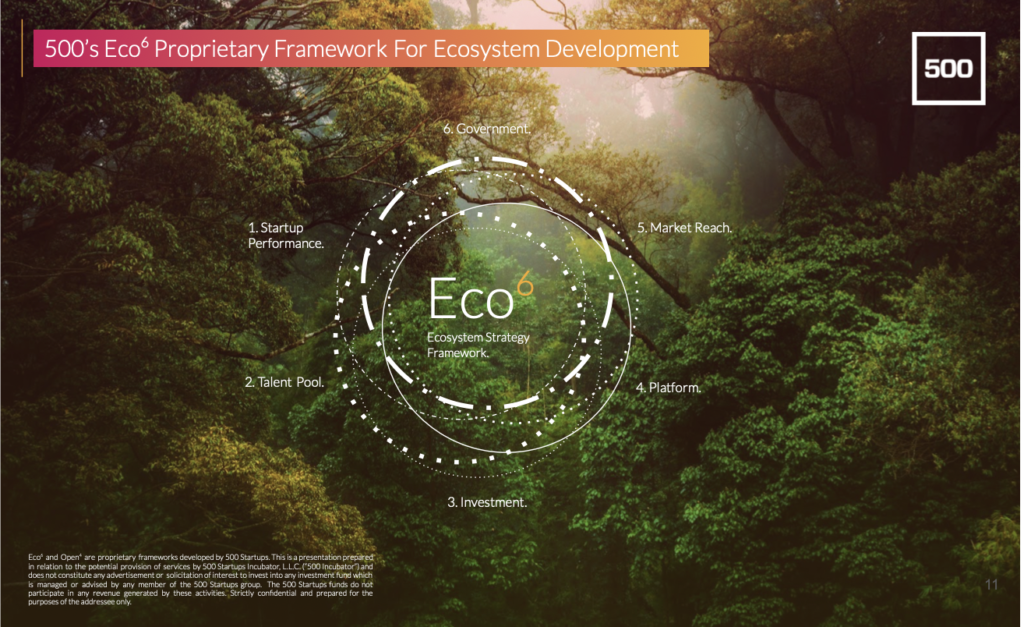

The Eco6 Proprietary Framework

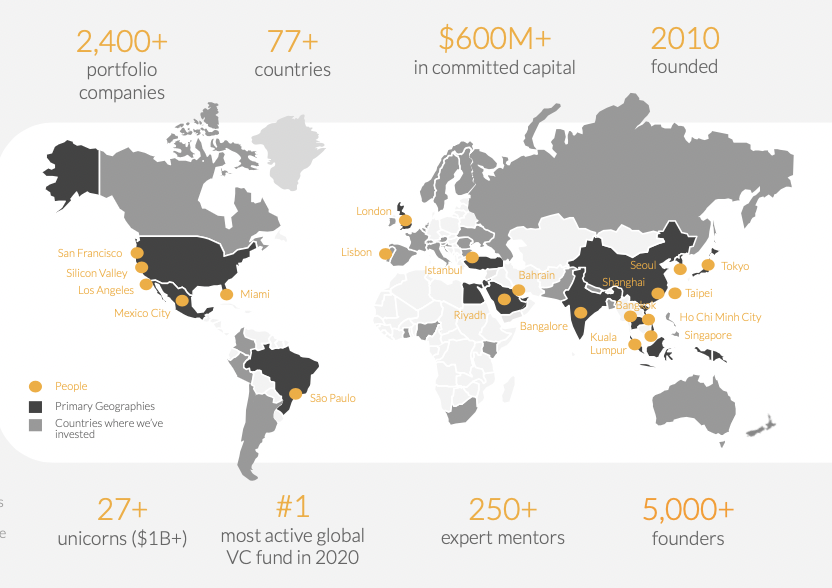

With a portfolio of more than 2,500 companies in 77 countries and 27 unicorns to date, 500 Global has positioned itself as a strategic partner in the development of startup ecosystems while also investing in startups emerging from these ecosystems.

Leveraging our research and experience, 500 has developed a strategic proprietary framework for ecosystem development, coined the Eco6. In this, we have identified six core elements that we believe are essential to building a thriving entrepreneurial ecosystem. Startup ecosystems are complex systems with numerous stakeholders and interactions among these. Through understanding the foundational elements of an ecosystem, we believe we can gain alignment and create a path for growth that builds upon a region’s unique strengths and fills the existing gaps today present in the ecosystem.

African ecosystems at the dawn of exponential growth

Our experience has shown that nascent and emerging startup ecosystems appear to rely on all six core elements that need to be activated and connected under a shared directional vision and clearly defined KPIs. A variety of African countries have already appeared to demonstrate, through the dedication of local stakeholders, that they can successfully activate one or multiple of these pillars, building their own unique strength and differentiation.

According to the Partech Africa 2020 Report, Nigerian and Egyptian startups alone command around 40% of Africa’s equity funding and several of the most valued companies on the continent. They have demonstrated what we view as significant startup performance and appear to be capturing the appetite of local and international investors, such as Future Africa Fund, Ventures Platform, Partech Africa, ABAN, Greentree Investment Africa, Launch Africa, Flat6Labs, ODV, Y Combinator, etc. With the recent acquisition of Paystack by Stripe and the unicorn valuation of Flutterwave, the Nigerian ecosystem continues to impress with the quality and performance of its startups. On the other hand, with increasing regional MENA fund activity and high quality entrepreneurs, Egypt has become a focal hub of startup activity and capital deployment recently supported by the “VC University” initiative jointly launched by Endure Capital, GIZ Egypt, MSMEDA, and Changelabs.

One of our perceived key foundations of successful startup performance is having a sufficient and healthy talent pipeline. With 60% of its population under the age of 25, Africa is home not only to the world’s youngest population but also one of the youngest and most promising workforce and talent pools available globally. Ranking first on Tunga’s relative number of developers per million population, Mauritius appears to have been driving the development of its startup ecosystem by emphasizing the importance of the development of its talent pool through initiatives led by both the public and private sector such as the inaugural African Leadership University. Similarly, South Africa ranks first on Tunga’s classification of an absolute number of developers per African country, which may have helped transform it into one of the leading tech hubs as well as hosting the top 5 best universities on the continent. Ethiopia, having the second biggest population size on the continent, is pushing efforts on connectivity and accessibility and is working to set the conditions to potentially become one of the most important talent pool sources in Africa led by the 10th continental top university, the Addis Ababa University.

In terms of investment, Kenya, with 21% of the total African funding according to the Partech Africa 2020 report, is seemingly attracting investment activity and activating additional forms of resources available such as GrowthAfrica, Tumi, Sheltertech Accelerator etc. On the other hand Ghana, in fifth-place in both total funding and number of deals according to the same report, appears to be experiencing both a surge in investment attractiveness for its startups and in quality ecosystem stakeholders like MEST, GIZ’s MakeItAfrica initiative, the Accra Angels Network, the Ghana Tech Lab, etc. This perceived momentum was recently highlighted by the $100 million Series C round of the Ghanaean startup Chipper Cash, a 500 portfolio company.

Smart Africa, a platform that aims to develop a single digital African economy with the direct support of 32 heads of states, chaired by the actual president of the republic of Rwanda, in my perspective has been a significant driver in setting the foundations for future initiatives with continental impact to lay on a Pan-African approach to ensure the connectivity of the continental startup ecosystem. I have also realized that Ivory Coast is one of the latest countries to have leveraged this opportunity by investing in one of the continental projects driven by Smart Africa to create funding opportunities for seed-stage startups across the continent. Additionally, initiatives such as Boost Africa jointly launched by the African Development Bank and the European Investment Bank, and VC4 Africa are facilitating access to investment opportunities, technical assistance, and networks across the continent.

Seemingly positioning themselves as aspiring role models in terms of market reach, Mauritius, Rwanda and Morocco are the top three countries in Africa with the best business climate on the World Bank Doing Business Index. They appear to prioritize the ease of doing business in their domestic markets as a lever to create a venture-friendly market locally and provide the foundations for market exploitation. With its objective to become a startup nation through exponential startup creation by creating 5000 Global over the coming years, Morocco is leveraging its ecosystem pioneers such as HSeven, La Factory, Hub Africa, and Startup Maroc to support the country.

In Tunisia, since 2018, the Startup Act and the Startup Tunisia initiatives led by Smart Capital, in our perspective, have been strong and sophisticated examples of how the government has taken the proactive approach to enable the activation of a startup ecosystem through a shared vision with the ecosystem stakeholders and the use of policy to implement that vision. This model has been replicated in Senegal, where I have witnessed that the government has endorsed the role of ecosystem enabler. It has not only adopted the Senegalese Startup Act but furthermore has established La Délégation de l’Entrepreneuriat Rapide D/J (DER) as the key agency driving the development of the startup ecosystem across Senegal.

Global Innovation Strategy – Africa

Through the launch of its Africa Innovation Strategy focus, 500 aims to support each region to leverage its unique competitive advantages and utilize its existing resources to activate the growth of its ecosystem while building connectivity bridges between regions towards a single pan-African vision.

Our objective is to locally run dedicated startup programs, capacity building interventions, corporate innovation strategy collaborations, education initiatives, and more, that we have witnessed to be transformational to emerging ecosystems in LATAM, South East Asia and the Middle East. 500 aims to co-design with local stakeholders such as governments, corporations, accelerators, investors, universities, and development agencies that are similarly committed to the long-term effort required to develop the African startup ecosystem. In addition to the intended direct interventions, we aim to create spaces of active conversations and reflections with existing leading initiatives by organizing open discussions particularly focused on Africa. With a growing appetite for African startups, our core belief is that talent is equally distributed but opportunities are not, which is one of the reasons why we place the work we will lead on the continent as one of our priorities through the dedicated unit of Africa Innovation Strategy.

We believe our approach to ecosystem development allows us to have a different outlook on the interventions needed to build and strengthen an ecosystem, beyond short-term programming initiatives. In addition to its existing framework, 500 would like to invite ecosystem stakeholders in the region to open conversations and to co-create locally tailored initiatives to support the most pressing needs of the African startup ecosystem. Above all, we would like to create an open and collaborative communication channel between 500 and the African ecosystem through our Africa Innovation Strategy platform. We truly believe in the power of the startup ecosystem as a central economic driver for the African continent, and as such are looking to build long-term foundations into the next generation of founders.

- Pitchbook: https://pitchbook.com/news/reports/2019-annual-global-league-table

- BCG Global. 2021. Overcoming Africa’s Tech Startup Obstacles. [online] Available at:<https://www.bcg.com/publications/2021/new-strategies-needed-to-help-tech-startups-in-africa> [Accessed 28 May 2021].

- Partech. 2021. 2020 Africa Tech Venture Capital Report | Partech. [online] Available at: <https://partechpartners.com/2020-africa-tech-venture-capital-report/> [Accessed 28 May 2021].

- BCG Global. 2021. Overcoming Africa’s Tech Startup Obstacles. [online] Available at: <https://www.bcg.com/publications/2021/new-strategies-needed-to-help-tech-startups-in-africa> [Accessed 28 May 2021].

- Multiple academic studies over the past three decades have empirically assessed the links between entrepreneurship and growth, employment, and innovation, including leading papers by Acs, Z. J. (1992), Small Business Economics; a Global Perspective, Challenge 35 Nov/Dec; Acs, Z. J. & Audretsch, D. B. (1990), Innovation and Small Firms, Cambridge, MA: MIT Press; Carree, M. A. & Thurik, A. R. (2002), The Impact of Entrepreneurship on Economic Growth, chapter prepared for the International Handbook of Entrepreneurship Research, Springer 2010

- Porter, M. E. (1990), The Competitive Advantage of Nations, New York: Free Press, p125

- This information is approximated as of December 31, 2020 based on internal data which has not been independently verified. The information provided here comes from the 500 Global family of funds. Further updated information is available upon request.

- College, B., 2021. More Than 250M Women Worldwide Are Entrepreneurs, According to the Global Entrepreneurship Monitor Women’s Report from Babson College and Smith College. [online] Prnewswire.com. Available at: <https://www.prnewswire.com/news-releases/more-than-250m-women-worldwide-are-entrepreneurs-according-to-the-global-entrepreneurship-monitor-womens-report-from-babson-college-and-smith-college-300960196.html> [Accessed 28 May 2021].

- Oecd.org. 2021. African Economic Outlook 2017: Entrepreneurship and Industrialisation | en | OECD. [online] Available at: <https://www.oecd.org/dev/african-economic-outlook-19991029.htm> [Accessed 28 May 2021].

- BCG Global. 2021. Overcoming Africa’s Tech Startup Obstacles. [online] Available at: <https://www.bcg.com/publications/2021/new-strategies-needed-to-help-tech-startups-in-africa> [Accessed 28 May 2021].

- According to Pitchbook. Pitchbook: https://pitchbook.com/news/reports/2019-annual-global-league-tables. This information is approximated as of June 30, 2020 based on internal data which has not been independently verified, and includes various ongoing accelerator programs and the following 500 Global funds: (a) 500 Global, L.P. and 500 Global-A, L.P., (b) 500 Global II, L.P. and 500 Global II-A, L.P. (together, “Fund II”), (c) 500 Global III, L.P. and 500 Global III-A, L.P., (d) 500 Global IV, L.P. and 500 Global IV-A, L.P., (e) 500 Global Annex Fund , L.P., (f) 500 Luchadores, L.P., (g) 500 Durians, L.P., (h) 500 Mobile Collective, L.P., (i) 500 Kimchi, L.P., (j) 500 TukTuks, L.P., (k) 500 Global JP, L.P., (l) 500 Global Istanbul, L.P., (m) 500 Luchadores II, L.P., (n) 500 Fintech, L.P., (o) 500 Durians II, L.P., (p) 500 Global Vietnam, L.P., (q) 500 Global Canada, L.P. *(“Canada”), (r) 500 Falcons, L.P., (s) 500 Global Korea II, L.P. and (s) 500 TukTuks II, L.P. and 500 Luchadores III, L.P. Note as of September 30, 2017, Canada’s investment period has been terminated and the fund will not be making any new investments.

- Partech. 2021. 2020 Africa Tech Venture Capital Report | Partech. [online] Available at: <https://partechpartners.com/2020-africa-tech-venture-capital-report/> [Accessed 28 May 2021].

- Techcrunch.com. 2021. Stripe acquires Nigeria’s Paystack for $200M+ to expand into the African continent. [online] Available at: <https://techcrunch.com/2020/10/15/stripe-acquires-nigerias-paystack-for-200m-to-expand-into-the-african-continent/> [Accessed 2 June 2021].

- Techcrunch.com. 2021. African payments company Flutterwave raises $170M, now valued at over $1B. [online] Available at: <https://techcrunch.com/2021/03/09/african-payments-company-flutterwave-raises-170m-now-valued-at-over-1b/> [Accessed 2 June 2021].

- Enterprise. 2021. Egypt was Africa’s most active destination for VCs last year | Enterprise. [online] Available at: <https://enterprise.press/stories/2021/02/11/egypt-was-africas-most-active-destination-for-vcs-last-year-31901/> [Accessed 2 June 2021].

- Digital Times Africa. 2021. Endure Capital, GIZ Egypt, MSMEDA, And Changelabs Are Launching “The VC University” Program To Support Emerging Venture Capital Fund Managers In Egypt And MENA. [online] Available at: <https://www.digitaltimes.africa/endure-capital-giz-egypt-msmeda-and-changelabs-are-launching-the-vc-university-program-to-support-emerging-venture-capital-fund-managers-in-egypt-and-mena/> [Accessed 2 June 2021].

- Cities Alliance. 2021. The Burgeoning Africa Youth Population: Potential or Challenge? | Cities Alliance. [online] Available at: <https://www.citiesalliance.org/newsroom/news/cities-alliance-news/%C2%A0burgeoning-africa-youth-population-potential-or-challenge%C2%A0> [Accessed 4 June 2021].

- Tunga. 2021. African Software Developers: Best Countries for Sourcing in 2021. [online] Available at: <https://tunga.io/african-software-developers-best-countries-for-sourcing/> [Accessed 28 May 2021].

- Tunga. 2021. African Software Developers: Best Countries for Sourcing in 2021. [online] Available at: <https://tunga.io/african-software-developers-best-countries-for-sourcing/> [Accessed 28 May 2021].

- https://www.usnews.com/education/best-global-universities/africa. 2021. 2021 Best Global Universities in Africa. [online] Available at: <https://www.usnews.com/education/best-global-universities/africa> [Accessed 2 June 2021].

- World Bank. 2021. New World Bank Financing Supports Ethiopia’s Goal of Universal Electricity Access by 2025. [online] Available at: <https://www.worldbank.org/en/news/press-release/2021/03/29/new-world-bank-financing-supports-ethiopia-s-goal-of-universal-electricity-access-by-2025> [Accessed 29 May 2021].

- Partech. 2021. 2020 Africa Tech Venture Capital Report | Partech. [online] Available at: <https://partechpartners.com/2020-africa-tech-venture-capital-report/> [Accessed 28 May 2021].

- Partech. 2021. 2020 Africa Tech Venture Capital Report | Partech. [online] Available at: <https://partechpartners.com/2020-africa-tech-venture-capital-report/> [Accessed 28 May 2021].

- Medium. 2021. The Great Debate: Why Ghana is the Country for Your Tech Startup!. [online] Available at: <https://medium.com/the-gps/the-great-debate-why-ghana-is-the-country-for-your-tech-startup-e30cc3ac295> [Accessed 2 June 2021].

- Techcrunch.com. 2021. SVB-led $100M investment makes Chipper Cash Africa’s ‘most valuable startup’. [online] Available at: <https://techcrunch.com/2021/05/30/africa-has-another-unicorn-as-chipper-cash-raises-100m-series-c-led-by-svb-capital/> [Accessed 2 June 2021].

- Tunga. 2021. African Software Developers: Best Countries for Sourcing in 2021. [online] Available at: <https://tunga.io/african-software-developers-best-countries-for-sourcing/> [Accessed 28 May 2021].

- hausse, L., Algérie, A., Bank, L., Green, C., africaine, L., stupéfiants, F., 2021, R., urgente, S., étrangères, L., d’approvisionnement, V., numérique, A., Université Mohammed VI Polytechnique Africa Business School, u., Audi Q5, u., La Citadelle, l., “La maternelle n’est pas une simple garderie”, a. and La Citroën C5 Aircross, l., 2021. Lancement du programme d’appui aux startups industrielles “Tatwir-Startup” – Medias24. [online] Medias24. Available at: <https://www.medias24.com/2021/02/15/lancement-du-programme-dappui-aux-startups-industrielles-tatwir-startup/> [Accessed 2 June 2021].